2023 CMIO Crash Course

The Intersection of Health Informatics & Digital Health: A CRASH Course for Leaders

Health informatics continues to advance through pioneering innovations at the intersection of people, technology, process, and data. In recent years the CMIO has been joined by Chief Health Information Officers, Chief Nursing Informatics Officers, Chief Data Officers, Chief People Analytics Officers, and more. As the health and healthcare industry tackles emerging business models, social determinants of health, and more informed consumers, technologies such as wearable devices, remote patient monitoring, virtual care and other digital health apps and platforms are becoming more prevalent in delivering healthcare services, and promoting better health and wellbeing.

Chief Digital Officers and Chief Innovation Officers are becoming important members of the leadership team. Join us on June 19 and 20th in advance of the AMDIS Physician-Computer Connection Symposium in Ojai, California to explore your role in this rapidly changing landscape. Whether you aspire to be a health informatics/digital health leader, are new to your position or are seeking to move to the next level, this symposium will help you connect with peers, further define your responsibilities, develop practical skills to help you progress in your career, and partner with others for success.

For over fifteen years, the CRASH Course has provided participants the opportunity for joint problem-solving and exploration of common challenges in a conversation-based format. Participants are surveyed in advance regarding the topics they want to address. Through a combination of presentations and facilitated discussions, attendees share experiences with each other and discuss lessons learned with AMDIS pioneers and healthcare industry thought leaders.

Register: https://amdis.org/2023-crash-course-registration/

Email hdavies@maestrostrategies.com for questions.

Cost: $575 per attendee

Agile Decision Making: Combining Insights with Instinct to Navigate the Unknown

Decisions are being made today that may alter a healthcare organization’s trajectory for years to come. The pandemic has revealed how unprepared we are as an industry to use real-time and predictive data to tell us “what is happening”, “what will happen” and “how do we make it happen.”

COVID-19 has upended conventional leadership thinking and challenged even the most astute to admit “we don’t know what we don’t know.”

We Must Think Differently

In recent years, the healthcare industry has made a significant investment in advanced analytics and encouraged a transition to insight driven decision making. A survey of healthcare executives conducted by Black Book in January 2020, indicated that the vast majority (93%) feel data analytics is crucial to helping meet future healthcare demands and make strategic decisions. Yet, utilization of advanced analytics was described as “negligible” by 80% of the respondents. 71% of surveyed executives said they were too busy to learn such systems. In our conversations with healthcare leaders, they indicate they prefer to delegate analysis to others, aren’t really aware of what data analytics options they have, and often prefer to rely on their instinct – after all, it’s what made them successful.

For many, they have relied on the hundreds of static spreadsheets and score cards providing weekly, daily, monthly, and quarterly reports on “what happened” to validate these instinctual decisions. Yet, in today’s world much of this history is not pertinent. Comparative benchmarks, based on pre-COVID operating models, are no longer valid. Even the most sophisticated data scientists cannot take this historic data, identify new patterns and build a model to predict the future based on our current circumstances in a rapid fashion. Even the fastest computer processor can’t generate the algorithms we need when the situation changes as rapidly as it does today. Advanced analytics tools such as machine learning and predictive modeling are at their best when the future environment is similar to the historic environment – and that’s not the case today!

Healthcare decision makers must think differently about the role of data in their decisions and their approach to making decisions.

Agile Analytics, Combining Insights & Instinct for Decision Making

In the emerging COVID world, decision makers need practical, short term, results driven answers to their questions. Influenced by interrelated factors such as numbers of positive cases, bed availability, medication and PPE supply, treatment protocols, deployment of virtual tools and the impact of social determinants on population segments, the problems we are trying to solve change constantly.

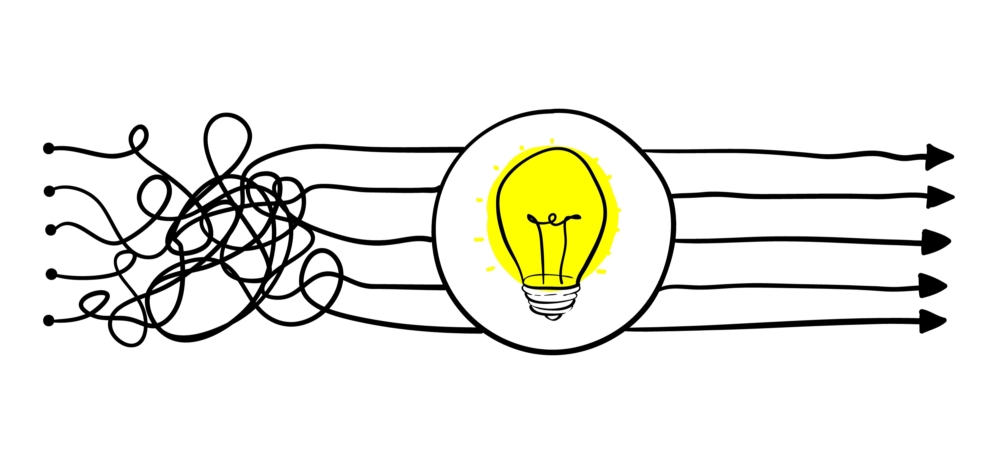

Agile Analytics is a new paradigm for healthcare decision makers and is focused on rapidly finding value in data.

COVID brings the need for quick turnaround of information and rapid decisions. Historic data trends and traditional, large scale analytics projects are not dynamic enough nor nimble enough to support today’s decision-making environment. Since “we don’t know what we don’t know”, we must learn along the way. Jumping to solutions, based on traditional best practice or the play books of the past may lead us down the wrong path. Yet, complex architectures and advanced analytics platforms may not be responsive enough to meet the challenges of the current environment.

Agile Analytics is a style of working and problem solving. Originally created by software developers in 2001, agile is a collaborative approach built on short one to three-week iterations resulting in a data output that can be used to solve a problem or make a decision. Each targeted iteration starts simply, explores key components of the problem and initial hypothesis, and provides decision makers directional insights to drive data stories and resulting conversations.

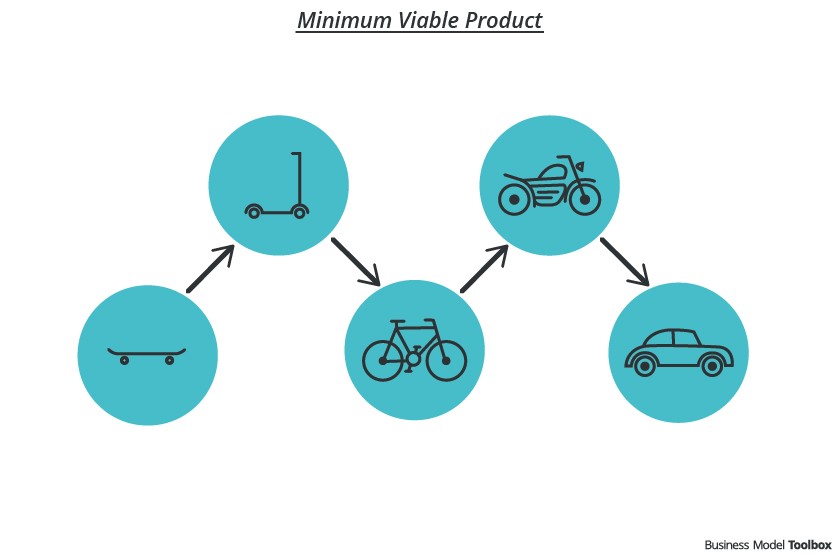

The Minimum Viable Analysis

A Minimum Viable Analysis (MVA), is similar to the Minimum Viable Product concept developed by Eric Reis of Lean Start-Up fame. “Rather than spending months even years perfecting a product (analysis) without ever showing it to a customer (decision maker)…we start with a simple prototype of the product (analysis) get feedback from the customer (decision maker) and learn, then build it out further through multiple feedback sessions and iterations.”

The MVA starts simply. As in the case of the minimum viable product, an initial problem to be solved or decision to make is identified by a small collaborative team of decision makers and data analysts. Using a travel analogy, rather than building an entire automobile to solve a transportation problem, the team starts with a skate-board as an initial prototype. This prototype defines data output, visualization or presentation expected from the MVA.

For problems the healthcare delivery organization is trying to solve during these times of uncertainty, a minimum viable analysis can be used to answer questions such as:

- When will we run out of ICU beds/ventilators?

- What staffing constraints will we have in acute care? in ambulatory? in post acute?

- What is changes should we make in our care model given the mix of virtual and in-person visits?

- What triggers will change our plans for rescheduling visits and procedures?

- Will we have PPE limitations or other supply chain issues?

Then, as specific questions are answered, an iterative approach can be used to add to the knowledge base and analysis to produce answers to more targeted questions or broader concerns.

We term the gap between the data output from our agile analytics effort and the change in behavior required to solve the original problem as the “Last Mile.” Unfortunately, the Last Mile is often an afterthought in analytics projects. Frequently, leading edge analytics initiatives don’t generate value or results due to ignoring the last mile. Resistance, lack of trust and transparency, siloed based behaviors, and a variety of last mile issues can often be anticipated and planned for early as problems and hypotheses are defined. Decision makers have a unique understanding of the environment where the desired insight-driven changes should occur. Instinct driven decision making plays an important role in defining Last Mile issues, early in the decision process.

COVID-19 brings a great deal of uncertainty, and decision makers can’t delegate data analysis as they did in the past. Multiple perspectives, judgement and experience are needed to collaboratively define the problems to be solved, potential hypotheses, explore the implications of analyses findings and communicate insight implications.

While data driven insights can provide new “aha’s”, they are best when combined with the decision maker’s instinct to navigate these uncharted waters.

Untangling Complexity: Agile Decision-Making During the COVID19 Crisis

“The system is not really geared to what we need right now… let’s admit it,” said Dr Anthony Fauci from the National Institute of Allergy and Infectious Diseases.

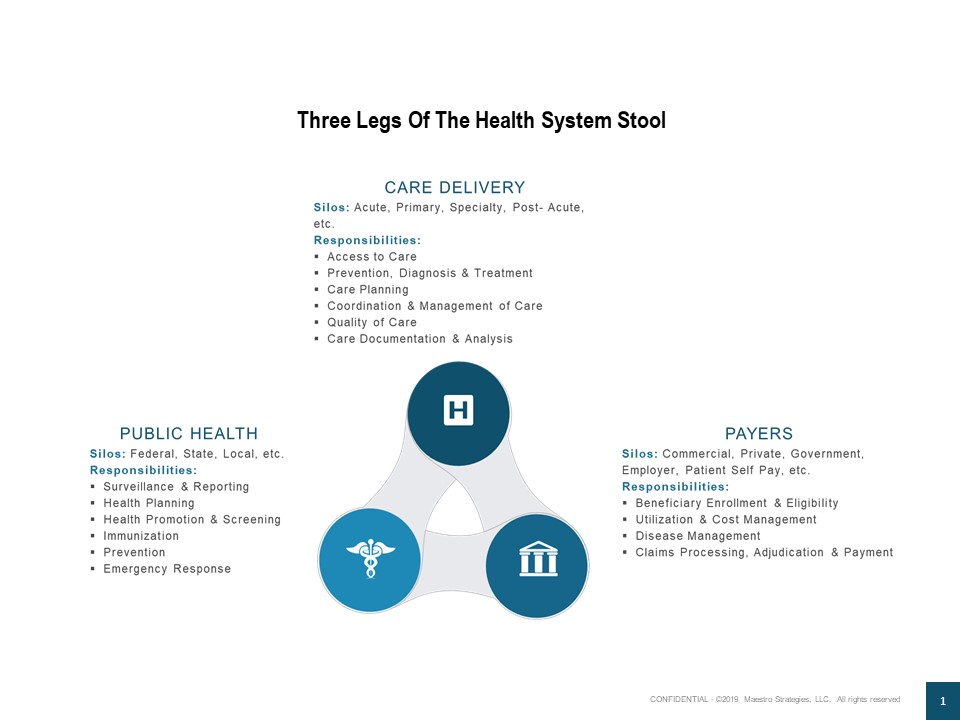

The outcry for testing from patients and the media has challenged the US government, public health leaders and clinicians in primary care and hospital emergency rooms as they the battle the COVID19 pandemic. It is clear, the complexities of test development and deployment are only the tip of the iceberg as our fragmented healthcare system ramps up our response.

In an ideal world, the public health, care delivery, and payment systems are all components of a unified system – a three legged stool of sorts, guaranteed not to wobble and each carrying its respective weight in managing the health of the US population. Yet, in reality the three legs of the stool rarely collaborate. Each with their own ingrained cultural, political, regulatory and economic incentives. In this world, distinct responsibilities, bureaucratic processes and information systems burden decision making and slow down response.

COVID19, knows no boundaries. In just a few short days, it is smashing the complicated mixture of federal, state, local, public and private organizational siloes and accomplishing more than many of us who have spent our careers trying to improve the system.

The March 17th expansion of telehealth benefits for Medicare recipients by CMS provides a tangible example. Relaxation of HIPAA rules gives the country’s older population access to medical care (both virus related and for other services) without having to leave their homes. Providers can use personal video chat applications like Apple FaceTime, Facebook Messenger video chat, Google Hangouts video, or Skype. Rather than deploying technology for technology’s sake as we have done in the past, this step demonstrates:

- Coordination across the silos of public health, care delivery and payment

- Design of a new way of working – based on the needs of the at-risk population and their care providers

- An agile decision that simultaneously untangled the complexity of the current system

- Rapid communication of the change through multiple media channels

- Quick tools forwarded to patients and their clinicians from health care industry associations, data and technology partners and advisors

The 9-11 Commission reported, “The 9-11 attacks revealed four kinds of failures: in imagination, policy, capabilities, and management’ (National Commission on Terrorist Attacks upon the United States 2004, p.339). Today, as we face this threat each step we take provides an opportunity to untangle the complexity, remove barriers and set the course for more agile and unified decision making. What other steps should we take?