Healthcare Analytics: Test the Waters Before You Dive In

Analytics as a Differentiator

Many healthcare organizations see the use of analytics as a primary differentiator in the journey to value-based care. The current analytics vendor marketplace includes:

- Niche and point analytics systems (solutions focused on one functional area – marketing, finance, clinical, claims, quality measurement, human resources, etc.)

- Enterprise analytics tools that are part of larger offerings such as ERP and EHR

- Enterprise data repositories, data lakes and tools to support data normalization, aggregation, visualization, etc.

- Extended enterprise systems such as care management platforms to support population health management and consumer activation

- External industry comparative data sets

Most health systems use these systems for a variety of analyses including:

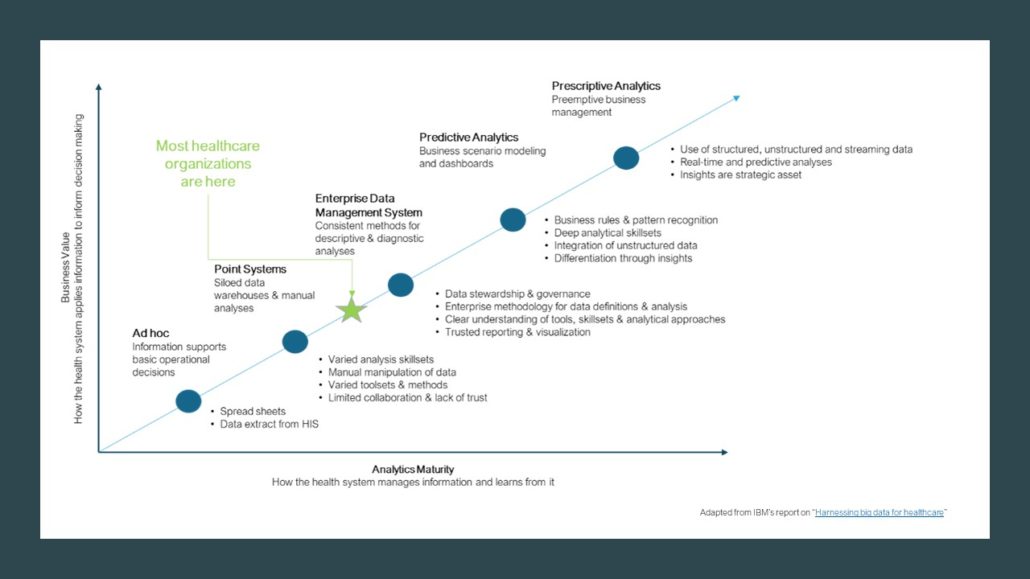

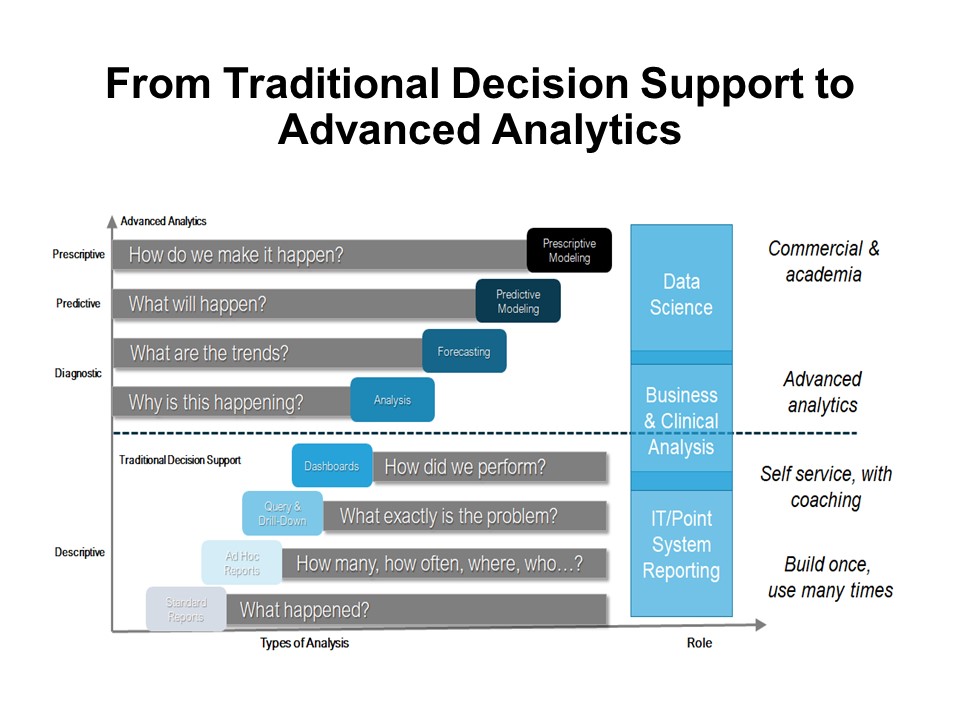

- Descriptive analytics – to answer questions such as what happened; how many, how often, where, who…; what exactly is the problem; how did we perform, etc.?

- Diagnostic analytics – to answer why is this happening and what are the trends?

- Predictive analytics – to answer what will happen?

- Prescriptive analytics – to answer how do we make it happen?

Advanced organizations are moving into Continuous Intelligence (CI). Rather than depending on traditional score cards, which require people to orchestrate every step in the analysis, CI uses artificial intelligence and machine-based algorithms to automatically interpret and harmonize the data. CI continuously discovers patterns and learns what’s of value in the data, and immediately sends insights to decision makers. In healthcare, this will be extremely valuable at the point of care, for care managers working across the continuum and for strategists who need agility in their decision-making processes.

Advanced organizations are moving into Continuous Intelligence (CI). Rather than depending on traditional score cards, which require people to orchestrate every step in the analysis, CI uses artificial intelligence and machine-based algorithms to automatically interpret and harmonize the data. CI continuously discovers patterns and learns what’s of value in the data, and immediately sends insights to decision makers. In healthcare, this will be extremely valuable at the point of care, for care managers working across the continuum and for strategists who need agility in their decision-making processes.

Demonstration Projects Help “Test the Waters”

Demonstration Projects Help “Test the Waters”

Yet, healthcare leaders often struggle with basic analytics projects. In fact, Gartner has uncovered an 85% failure rate on data projects. Ironically, this may be in part the result of executives trusting their gut rather than the insights derived from the data. Other problems include political, data quality challenges, limited data interpretation skillsets, resistance to change, governance, etc. It is often helpful, prior to jumping in the deep end of the analytics pool for the organization to first:

- Learn new ways to think about data

- Collaborate on new ways to use data

- Leverage existing analytics tools and resources prior to making significant analytics investments

- Develop consistent methods for defining the problem to be solved, defining the data, cleaning up data inconsistencies and improve on data presentation skills

In other words, “test the waters” prior to diving in. A Demonstration Project provides the ability to learn about insight-driven decision making through the execution of a clearly defined project. The Demonstration Project works best with a limited scope, limited resource commitment and within a short time frame. An Analytics Demonstration Project focuses on data quality, building trust and deploying a consistent data management methodology. Insights can be channeled into performance improvement projects, strategic and operational plans or other pertinent initiatives.

Leading Demonstration Projects

Often a “See One”, “Do One”, “Lead One” approach works well — an outside analytics advisor partners with the organization and leads the first project, the advisor partners with the organization on the second project and in the third project, the organization leads the project with the advisor serving as a mentor. Preparation and starting the project well are essential elements for success and key steps include:

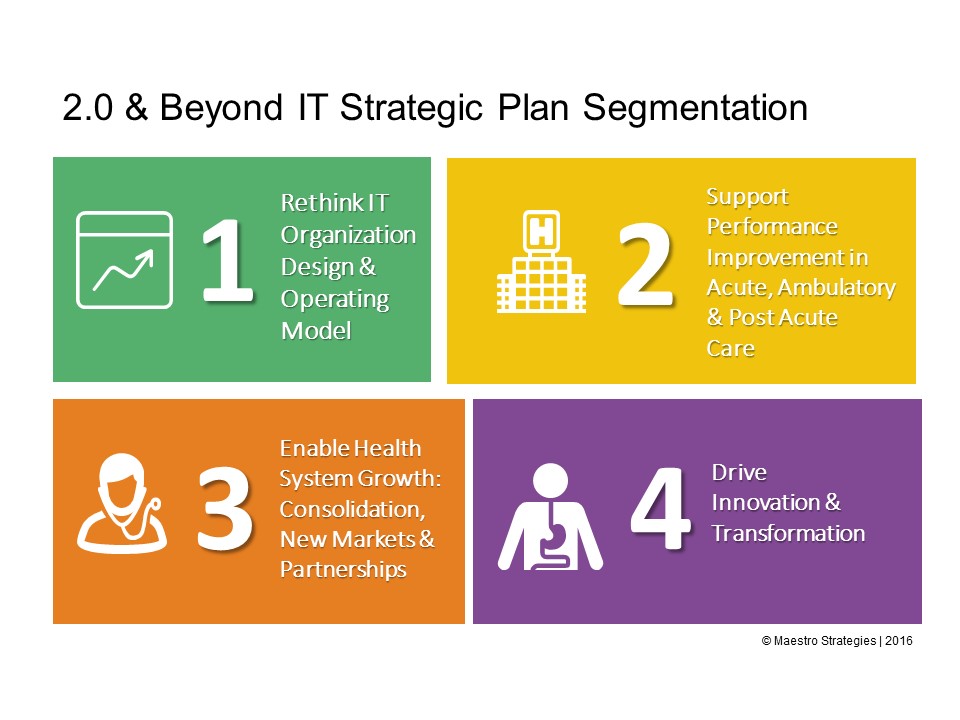

- Understand the problems you are trying to solve: Many organizations acquire solutions before they have identified what the organizational “points of pain” are. This results in multiple tools or platforms competing for leadership attention, budget dollars and resources. Identifying the problems you are trying to address, or the questions you are trying to answer will help prioritize the use of limited analytics capacity.

- Evaluate your existing investments in analytics tools, systems and methodologies: It is essential to understand your current analytic tools footprint. Rather than jumping to acquire a new analytics system or service, you may find you are able to leverage existing investments. Over time, the lessons learned from successful Demonstration Projects will identify opportunities to improve your overall Analytics Strategy. Specifics may include rationalization of duplicate systems and addition of new capabilities to close gaps based on your existing vendor’s development road map.

- Break Data Analytics projects into smaller waves versus a big bang deployment: Focused sprints, using an agile methodology rather than a traditional IT waterfall project implementation plan, shifts the focus to performance improvement. For the purpose of planning a Demonstration Project there are many ways to break the problem into smaller, targeted efforts. So for example, a Sepsis prevention and reduction effort can be divided into multiple smaller Demonstration Projects including descriptive and diagnostic analysis of sepsis rates, use of data driven screening tools or protocols, sepsis prediction tools, stakeholder education through data, etc.

- Ensure data integrity: Source systems (such as your EMR or niche systems) have varying quality of data. Oftentimes data are missing or stored in different places depending on clinical documentation practices. In addition, definitions of data may vary from system to system or even from stakeholder to stakeholder. A common “Data Dictionary” becomes essential. Demonstration Projects can be useful defining organizational steps in developing the data dictionary, mining data, validating data, creating data baselines, analyzing data, presenting and visualizing data, and developing a go-forward data improvement plan.

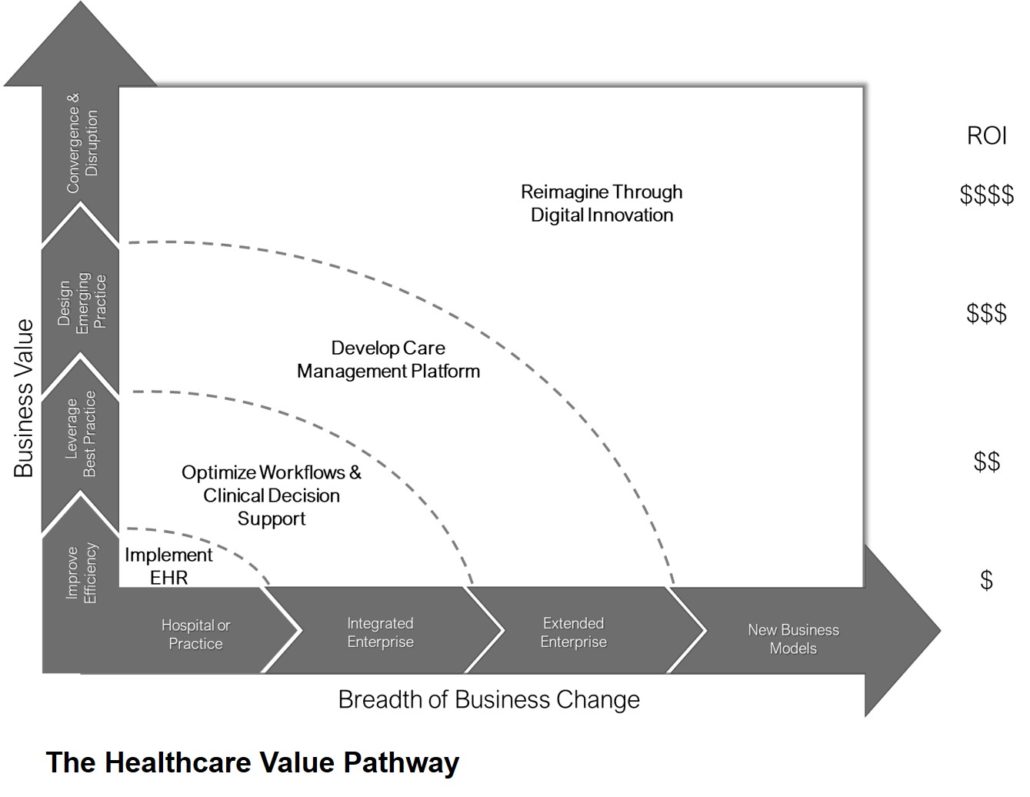

- Communicate benefits to the organization, including executives: Use techniques to model value and even Return on Investment/Value of Investment. By showing how Data Analytics initiatives impact strategic goals as well as daily operations, the organization can begin take a holistic view and integrate insight-driven decision making at all levels of the enterprise.

Organizations who leverage the strategic value of data to make informed decisions will be the ones who not only survive, but thrive.