Health executives have realized for a long time that future success is tied to the quality of their information. Finance organizations have worked with costing, budgeting and financial decision support systems for years. Supply chain executives have created reporting tools to manage inventory, distribution and cost. Operations leaders have reported quality, productivity and performance improvement metrics. Yet, as we move from fee-for-service to value based care, many are challenged with the terms Business Intelligence, Analytics and Population Health Management. With hundreds of new vendors entering the marketplace and knocking on health system doors, we have moved to a new “wild, wild west” – one that can be very confusing. Most health systems already have an extensive array of capabilities around analytics including point systems (e.g., what their surgery system can report), multiple data repositories with duplicate but often conflicting information, and capabilities provided by existing core vendors. Additionally, there are oftentimes hundreds of data analysts across the organization that are managing and massaging scorecards, gathering and interpreting data from multiple internal and external sources, and creating literally thousands of excel and other “one-off” analyses. This creates a complex assortment of information for decision makers, and begs the question: “What is truth and where does it lie?”. To further complicate the situation, the mergers, acquisitions and the rapid deployment of electronic health records and other advanced clinical systems in recent years have made the identification of real “knowledge” a continuing challenge. And the sad fact is that most organizations spend the majority of their time collecting data and very little time analyzing that data. As we move from volume to value, it will be critical that organizations have a way to quickly collect the data, dedicate a more thorough effort to understanding what the data means and then acting on the data to produce results. In other words: Organizations must become data-driven in the decision they make at both the strategic and operational level. What most health systems don’t have is a comprehensive plan for data. They lack organizational accountability for data management or a process for ensuring data integrity, standards for collecting, aggregating, normalizing and presenting the data, and governance approaches to reducing duplication, complexity or political arguments over control. A Business Intelligence and Analytics Strategy can help address some of these challenges, and should begin with answers to four questions:

- What are the important enterprise business drivers and priorities that information must support?

- How are strategic and operational decision made today and what changes must occur to move to an information driven decision making process?

- How will you launch an early stage data governance and stewardship process?

- What leadership input is needed to oversee and coordinate Business Intelligence? What talent is currently available within the enterprise and what is needed? Is the function centralized, decentralized or a hybrid structure?

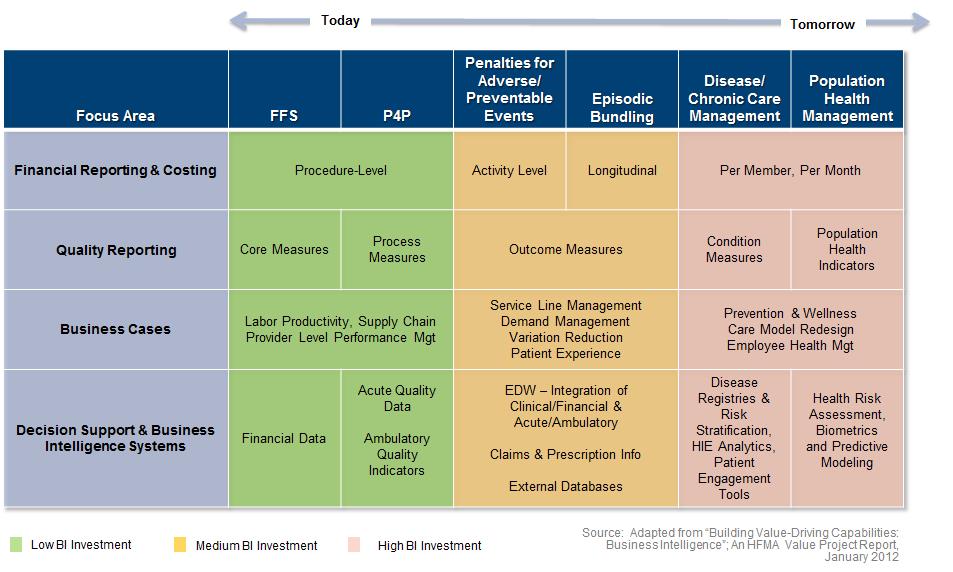

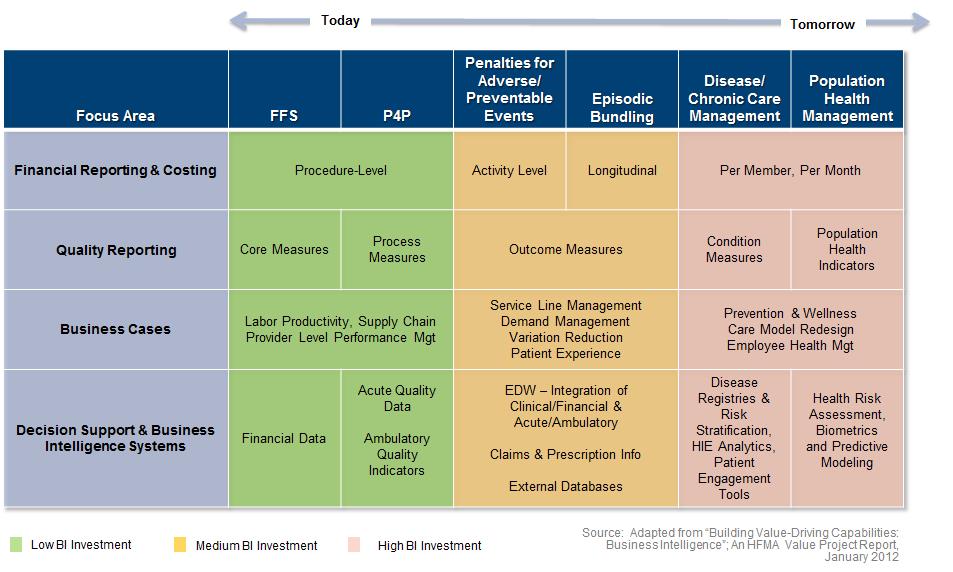

Then, and only then, can a strategy around architecture, tools, and technology be defined. Depending on the evolution of your enterprise strategy and the level of risk managed, the requirements and investment vary. Rather than adding further complexity through new layers of tools, technologies and systems, the development of an enterprise Business Intelligence Strategy can provide a short term (12-18 month) plan to ensure that overall gaps are identified, existing systems are leveraged, skills of existing analysts are utilized, decision making structures are fine-tuned, and additional tools are selected in a rational manner.

Evolution of Business Intelligence Requirements & Investment